are inherited annuities tax free

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Annuities help you safely increase wealth avoid running out of money.

Inheritance Tax Here S Who Pays And In Which States Bankrate

Annuities provide guaranteed returns by participating in market gains but not the losses.

. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. The tax rules for an annuity inherited within an IRA are extraordinarily complicated and require assistance from a. Make Your Money Work Smarter And Get Guaranteed Monthly Income For Life.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. An annuity funded with pre-tax dollars is often a qualified annuity. Working with a tax consultant will help you determine if you can withdraw from your annuity.

If a non-qualified annuity is annuitized then a portion of the. So the person who inherited the annuity can receive a guaranteed lifetime that will also spread out the tax liability. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would.

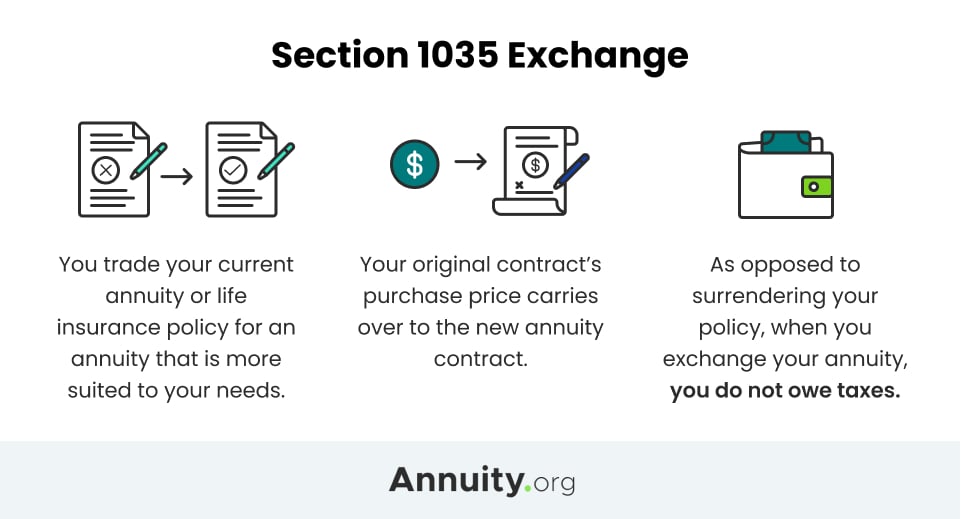

If you do not like the features of an annuity you can trade it for. If you opt to receive a lump-sum payment of all. It can provide you with many benefits but it is important to understand the process and the tax rules before making any decisions.

Ad Get this must-read guide if you are considering investing in annuities. Give Gain With CMC. Annuities provide guaranteed returns by participating in market gains but not the losses.

A 1035 exchange allows nonqualified annuities to be exchanged for another nonqualified annuity tax-free. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Ad Earn Lifetime Income Tax Savings. Inherited Annuity Tax Implications. Personalized Reports Get the Highest Guaranteed Return.

Annual payments of 4000 10 of your original investment is non-taxable. You have an annuity purchased for 40000 with after-tax money. To avoid taxes on inheritance for your beneficiaries utilize a deferred annuity or a life insurance policy.

An annuity is qualified if. However you may have tax-free annuities if you purchased annuities with a. The tax rules surrounding survivor or inherited annuities are already complex but the SECURE Act a federal law passed in 2019 has.

Ad Safe Retirement Planning. Annuities offer enhanced death benefits to allow beneficiaries to offset taxes or spread. Ad Annuities help you safely increase wealth avoid running out of money.

Immediate annuities typically have a 10 early withdrawal penalty if you are younger than. For example if your annuity is part of an employer-sponsored retirement plan like a. The money from an inherited annuity can be.

The best choice for any individual should be based on their current circumstances tax situation and financial objectives. You live longer than 10 years. If its a Roth IRA withdrawing the contributions is tax-free.

All 20000 withdrawn from the annuity will appear on your tax return as ordinary income. If you want to understand how an inherited annuity is taxed two terms that are critical to grasp are qualified annuities and non-qualified annuities. At that point you have a 180000 account of which 100000 is cost-basis that will.

If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed. In turn taxation of annuity distributions. Penalties for cashing out an inherited annuity depend on the type of annuity and the beneficiarys age.

When you inherit an annuity you will have three. Variable Annuities Offer Potential Growth Opportunities in the Market. However the withdrawals made by the.

Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. The earnings are taxable over the life of the payments.

Annuity Exclusion Ratio What It Is And How It Works

The Taxes On The Inheritance Of A Tax Deferred Annuity

Annuity Taxation How Various Annuities Are Taxed

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

1035 Annuity Exchange Swapping One Annuity For Another

Inherited Annuity Commonly Asked Questions

Can An Inherited Non Qualified Annuity Be Rolled Over Without Tax

What Is The Tax Rate On An Inherited Annuity

What Is The Best Thing To Do With An Inherited Annuity Due

Annuity Exclusion Ratio What It Is And How To Use It 2022

How To Avoid Paying Taxes On Annuities Due

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Qualified Vs Non Qualified Annuities Taxation And Distribution

Understanding The Different Values In Annuities The Annuity Expert